By John Duggan, EVP of Sales, APAC at Daon

Facial recognition, especially when combined with step-up authentication, provides an identity assurance paradigm that is not only resilient, but futureproof. For organizations in banking and financial services, embracing biometric authentication is more than a strategic move: it’s an executive mandate to strengthen trust and increase accessibility in the digital age.

According to Bankrate, the use of mobile banking as users’ primary method of account access increased from 15.1% of consumers in 2017 to 48% in 2023. Plaid reports that U.S. consumers managing their finances with technology jumped from 58% in 2020 to 80% in 2022, “meaning more people use fintech products than social media.” In the EU, online banking penetration reached 66% in 2022.

But face recognition doesn’t mean traditional banking is going away; it simply means that biometric technology can make things easier for customers, business owners, and employees to access, conduct, and improve (respectively) the services offered.

Biometrics, Banks, and Customer Bliss

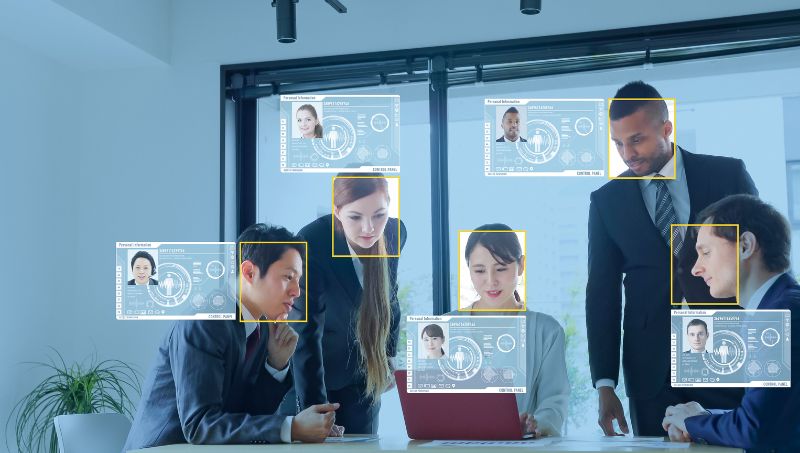

Biometrics authenticates users not by what they know (like a password or security question), but by who they are (like facial recognition).

Biometrics is immune to the types of fraud that passwords and other knowledge-based authentication (KBA) factors are vulnerable to, like phishing, social engineering, man-in-the-middle, and other kinds of attacks. Biometric facial authentication is simple for customers and only requires them to take a selfie with their smart phone. There’s nothing to remember, nothing that can be lost, and no other items necessary for the user to have in their possession besides their phone.

In addition, banks looking to implement biometrics don’t need to make any investments in fancy tech: every smartphone with a camera that is widely available today has the high-res optimization and image quality necessary for a user to capture a facial biometric.

When a person opens a bank account, wishes to conduct a high-risk transaction, or wants to change their account information, the system extracts the unique identifying points of their facial scan into a mathematical representation of the user – a biometric template. When the customer returns, their live facial scan is compared to the stored template. While these templates are stored in databases, even if they are stolen, they are of little use to criminals. They cannot be hacked or reverse-engineered, and simply having the template alone isn’t enough to access an account. The template must be paired with a live scan from a legitimate customer to unlock account access.

Facial recognition has staked its claim as the gold standard of biometric methods. Its universality, fused with unparalleled consistency and the promise of unobtrusive authentication, lends it an edge that resonates with everyone – from the average user to the executive suite. Tech industry leaps in artificial intelligence and machine learning have honed the precision of facial recognition systems, amplifying their popularity.

Improving CX

The promise of biometric technology isn’t just a pretty face: face recognition has the power to revolutionize banking and reinvigorate the customer’s experience. Because while security is certainly critical, banks need to think about more than that and embrace the bigger picture of a customer’s lifecycle with their brand. For example: How easy is it for customers to use your authentication methods? Is it convenient for them? Is it too complicated? Are there too many steps in the process?

When Daon speaks with clients in financial services, we tell them to focus on finding the right balance between security and customer convenience by reducing possible points of friction. Face biometrics is frictionless, fast, and highly secure – offering the best of both worlds to banking organizations.

Banking for All

This rise in banking and in using financial services via technology rather than through traditional methods and brick-and-mortar branches has powered a new era of inclusion for consumers around the world. Technology (like face recognition) removes barriers that have kept customers from participating in the mainstream financial system.

The World Economic Forum found that one in six people globally are living with disabilities and that households with PLWD (persons living with disabilities) are three times as likely to be unbanked as those without household members living with disabilities. “Fintech provides convenience, financial records, and safety. It can provide personalized financial services with assistive technology to people with disabilities, helping them to overcome barriers to inclusion,” wrote the Forum.

Biometrics overcomes the challenges of living in areas where a physical bank may be miles or hours away, enables choices – since a consumer isn’t confined to doing business with a local bank – and can reduce the cost of banking with digital-native platforms and processes. This technology has enabled millions of people around the world who were previously unbanked to open accounts.

Wider and more convenient access to all kinds of financial services and bank apps that use biometrics enables better lives for every person across the globe. This access fosters financial inclusion, which allows consumers and citizens to be treated with respect as they start or grow their own businesses, to avoid being turned away from businesses that refuse to take cash, save against a rainy day or for a bright future, and to create a better life for their family and community.

To learn more about biometric facial authentication, visit us online.

About Daon:

Daon, the Digital Identity Trust company, enables market-leading organizations worldwide to easily and accurately proof, verify, authenticate, and secure customer identities at every trust point across the entire customer lifecycle. With industry-leading identity proofing and biometric authentication technologies at its core, Daon’s technology ensures that customer identities are accurately verified, safely secured, and easily recovered. By mitigating fraud, reducing friction, and ensuring regulatory compliance, Daon helps businesses deliver a seamless customer experience, increase customer satisfaction, and reduce costs. Daon delivers these solutions through its AI and ML-powered IdentityX® platform, chosen by leading companies in financial services, telco, travel & hospitality, and other industries to secure and process hundreds of millions of digital identity transactions daily. Learn more at www.daon.com.