Rethinking Deposit Growth: Lessons From a Fireside Chat on Digital Trust, Distribution, and the Future of Acquisition

Consumer behavior in banking has undergone one of its most significant shifts since the introduction of online banking itself. Customers now evaluate financial products through digital filters long before they ever reach an institution’s website — and long after brand loyalty has weakened. The result is a competitive environment where rates matter, but digital trust and distribution matter more.

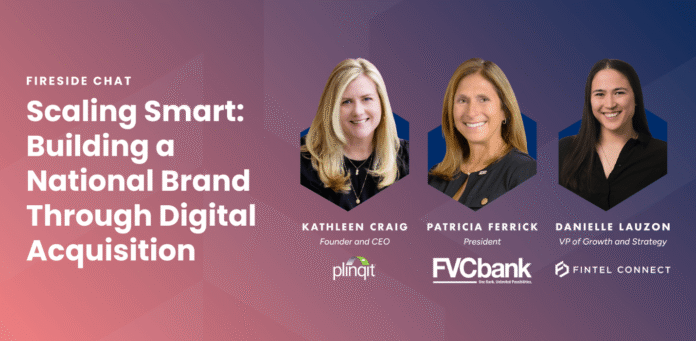

During a recent fireside chat with leaders from FVCbank, Plinqit, and Fintel Connect, panelists explored what this means for banks and fintechs navigating deposit pressures, onboarding friction, and the rising cost of attention. What emerged was not a discussion about channels or products, but a clearer picture of how institutions must reposition themselves for a new era of consumer decision-making.

This recap highlights the most actionable takeaways and industry implications for fintech leaders, bank executives, and innovators shaping the future of financial acquisition.

The Panel

- Danielle Lauzon, VP of Growth & Strategy, Fintel Connect (Moderator)

- Kathleen Craig, Founder & CEO, Plinqit

- Patricia Ferrick, President, FVCbank

Setting the Stage

The webinar kicked off by setting the stage: FVCbank, a $2.3B community bank with eight branches across Virginia, Maryland, and DC, built growth in strong relationships and personalized service. Plinqit helps banks engage customers and grow deposits. FVCbank initially partnered with Plinqit to boost deposits – but they quickly realized that breaking into new markets meant digital reach was necessary.

That’s where Fintel Connect’s expertise came in. As the only affiliate platform built specifically for financial institutions, Fintel Connect helped FVCbank:

- Position their product in new markets

- Make the leap into digital acquisition channels and expand their reach

- Invest in performance-based acquisition through trusted affiliate partners

“We wanted to be able to diversify our portfolio mix, offer competitive products and see how to grow outside of our market. Get core customers and get core deposits outside of our market” – Patricia Ferrick, FVCbank

1. Deposit Competition Has Shifted From Product to Access

Historically, the formula for deposit growth was straightforward: competitive rates, strong local reputation, and reliable service. But panelists acknowledged a structural change — products have become commoditized, and competitive rates alone no longer guarantee meaningful inflows.

The more defining variable today is access:

- access to national audiences

- access to digital trust networks

- access to distribution channels where customers are actually making decisions

Institutions built around physical geographies are increasingly competing with digital-first brands that distribute nationally from day one. This is especially visible among community and regional banks that traditionally relied on branch presence and word-of-mouth.

The lesson is clear:

Deposit growth now depends on being discoverable, not just being competitive.

2. Third-Party Trust Is Now a Core Part of the Customer Journey

One of the strongest themes that emerged was the evolving path to purchase. Customers rarely start on a bank’s homepage anymore. They begin with:

- aggregator sites and financial marketplaces, e.g. NerdWallet

- educational publishers

- fintech apps

- influencers and content creators

- comparison engines and product review platforms

These trusted third parties now sit between banks and their prospective customers, shaping early perceptions and guiding decision-making before consumers ever see an institution’s own messaging.

This shift has major implications:

- Banks no longer control the narrative — credibility is now earned externally.

- Discovery is happening in distributed, not centralized, environments.

- Performance-based partnerships are becoming essential, not optional.

It also reframes marketing spend: instead of buying attention, institutions are buying credible placement inside trusted ecosystems where intent is already high.

Off the back of this, once these trusted relationships are established. Financial brands are leveraging them to be discovered and cited on LLM platforms like ChatGPT, Perplexity, and Copilot. Learn more here.

3. Performance-Based Partnerships Reduce Risk and Improve Precision

A notable insight from the discussion was the growing acceptance of performance-based acquisition among institutions that historically relied on broad, upfront spend models.

Performance partnerships introduce a model many fintechs adopted years ago:

pay only when a qualified customer converts.

For banks facing narrowing margins and tightening budgets, the benefits are significant:

- Lower acquisition risk — spend is tied to measurable outcomes

- Better alignment with leadership expectations

- Higher-quality leads from informed consumers

- Predictable cost structures that scale with success

This approach also encourages institutions to think more strategically about funnel performance, since inefficiencies directly affect both cost and volume.

The panel framed it not as a channel choice, but as part of a broader movement toward accountable acquisition.

4. Digital Onboarding Is Becoming the New Battleground

One of the most practical — and surprising — insights came from Plinqit’s observation that many senior banking leaders have never opened an account online with their own institution. This lack of firsthand visibility often results in underestimating the impact of friction on conversion and cost.

But as panelists stressed, onboarding is no longer just an operational concern. It is a marketing lever, a cost lever, and a trust lever.

A slow or cumbersome process:

- decreases conversion

- increases acquisition costs

- frustrates affiliates and partners

- introduces reputational risk

On the other hand, a seamless experience becomes a competitive differentiator in itself.

The industry implication:

Institutions cannot meaningfully scale digital growth without treating UX as part of the acquisition engine.

5. Leadership Buy-In Requires Reframing Marketing as Investment, Not Cost

A persistent challenge for many banks is securing leadership support for new acquisition initiatives, especially those involving digital channels that feel unfamiliar or “non-core.”

Panelists shared a practical strategy used to build internal alignment:

tie marketing investment directly to deposit targets.

For example:

“If the goal is $10M in deposits, allocate 0.5% of that goal as a test budget.” – Kathleen Craig, Plinqit

This reframes acquisition as a small, controlled experiment rather than a major upfront commitment. Because many digital channels — particularly performance-based ones — only incur cost when accounts open, the financial logic becomes easier to defend internally.

This approach also mirrors how fintechs build acquisition momentum: test, measure, validate, scale.

6. National Expansion Requires a Learning Engine, not a Linear Plan

Perhaps the most forward-looking takeaway was the notion that digital expansion isn’t a campaign — it’s a system.

The institutions best positioned to scale nationally will adopt the following mindset:

Test-and-Learn Culture

Iterating on messaging, partner mix, rates, and funnel friction until the model hits efficiency.

Balanced Economics

Maintaining competitive rates while investing the “spread” into acquisition channels that create consistent visibility.

Distribution Diversity

Avoiding overreliance on any single channel by layering affiliate partnerships, paid media, marketplaces, and co-branded initiatives.

Conversion Optimization

Treating every part of the journey — from comparison site listing to onboarding screens — as part of the same growth system.

This mirrors broader fintech behavior, where scale comes not from one big lever, but from systematic refinement across the entire customer lifecycle.

Conclusion: Digital Trust Is the New Currency

The fireside conversation underscored a transformation underway across the sector:

deposit growth is increasingly a function of trust, transparency, and usability — not just rate leadership.

Financial institutions that succeed over the next several years will be those that:

- participate meaningfully in third-party trust ecosystems

- embrace accountable, performance-linked acquisition models

- prioritize onboarding as a strategic differentiator

- invest in distributed digital visibility

- build internal cultures that support experimentation and iteration

The industry is moving away from a world where banks wait for customers to come to them. The future belongs to institutions that are discoverable, transparent, and frictionless from the first point of contact.

Check out the full breakdown in the recording here!

Author Bio

Danielle Lauzon is the VP of Growth & Strategy at Fintel Connect, where she helps financial institutions modernize their digital acquisition strategies through compliant, data-driven performance models. With experience spanning fintech partnerships, growth frameworks, and customer acquisition, she focuses on bridging the gap between traditional banking and emerging digital ecosystems. Danielle advises banks and fintechs on building scalable, sustainable programs that balance trust, efficiency, and long-term value creation.