By Jasika Walia, Business Analyst at FischerJordan with an interest in strategy and problem solving. Appadwedula Sai Naryana Apoorv, summer intern at FischerJordan working at the intersection of analytics and technology.

Introduction

In the ever-evolving landscape of the global financial system, banking crises have emerged as recurring phenomena with profound economic and social implications. Impact of these tumultuous events, often characterized by the collapse or severe distress of financial institutions, reverberate across economies, disrupting stability, eroding public confidence, and challenging policymakers and regulators alike. Understanding the complex dynamics and multifaceted nature of banking crises is crucial to prevent their occurrence, mitigate their effects, and foster a resilient financial system.

This paper explores the underlying causes and the impacts of banking crises. By examining historical episodes of banking crises and drawing on contemporary events, we aim to shed light on the intricacies involved. We then dive into a few commonly used analysis approaches for examining the financial health, relevance and efficiency of institutions.

The failures

Silicon Valley Bank (SVB), Signature Bank, and Credit Suisse all experienced banking failures in March 2023. The failures of SVB, Signature Bank, and Credit Suisse have raised concerns about the stability of the global banking system.

The failures of these banks have also led to calls for reform of the financial system. Adam Guren, associate professor of economics at Boston University’s College of Arts & Sciences, mentions that once the crisis is dealt with, analyzing what happened and why, will be critical.

Right now, we’re in the fire phase. We need to put the fire out. -Adam Guren [1]

In this article, we wish to understand:

- What ignited this fire of banking failures?

- Was it possible to predict the fire?

I) What ignited the fire of banking failures?

a) The moth

Banks are intermediaries. They take in deposits – which are both their chief liability and chief source of funds. Banks then take these deposits and lend them to borrowers and invest them in a range of fixed-income securities such as government bonds. Table 1 is a simple bank balance sheet that illustrates why banks are vulnerable to failure.

The first source of vulnerability is that demand deposits are redeemable on request. In other words, depositors can withdraw all their deposits from the bank at the push of a button. Time deposits can usually be withdrawn immediately, but there is typically a penalty for doing so, such as forgone interest payments.

The second source of vulnerability is that bank assets such as loans and securities are illiquid. In other words, it is costly to turn them into cash on short notice.

Banks take in deposits that have a short maturity and invest them in securities and loans that have a long maturity. The difference in interest rates between these two is how they make their money.

But what happens if lots of depositors want to withdraw their money at the same time? Our example bank in Table 1 holds cash to meet excess withdrawals, but this can be quickly exhausted. The bank would then have to sell its securities to meet withdrawals.

| Assets ($) | Liabilities ($) | ||

| Securities | 45 | Demand deposits | 45 |

| Loans | 45 | Time deposits | 45 |

| Cash | 10 | Shareholder’s Capital | 10 |

| 100 | 100 | ||

The issue with having to sell securities is that their values may have fallen since they were purchased by the bank. This can happen simply because interest rates have increased in the interim. A rise in interest rates pushes down the price of fixed-income securities. This could potentially mean that the bank does not have enough assets to cover its deposits.

This is where shareholder capital comes in: it helps to absorb the fall in the value of securities, acting as a buffer. But what happens when this capital is exhausted? At this point, the bank is insolvent. Central banks and regulators have long recognised the fragility of banks and their susceptibility to bank runs.

b) The flame

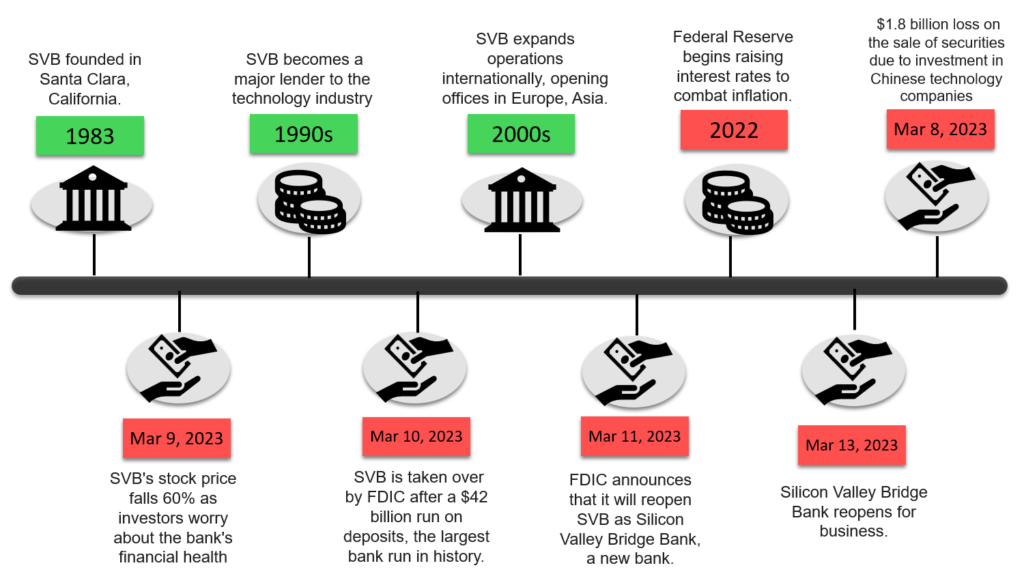

1. SVB

Silicon Valley Bank failed just 14 days after KPMG LLP gave the lender a clean bill of health. [3]

Timeline

Reasons for failure

| S.No | Heading | Description |

| 1 | Heavy exposure to the technology industry | SVB was heavily exposed to the technology industry, which was hit hard by the recent sell-off in technology stocks. The bank’s loan portfolio was concentrated in technology companies, and the loss of value in these assets contributed to the bank’s financial problems. 44% of the venture-backed technology and healthcare initial public offerings (IPOs) in 2022 were clients of Silicon Valley Bank. The startup and the tech winter both affected SVB heavily with companies facing cash crunch due to lack of funding and ultimately resorting to their savings for expenditure. [4] |

| 2 | Rising interest rates | The Federal Reserve began raising interest rates to combat the prevailing inflation in the US. This made it more expensive for SVB to borrow money and reduced the demand for business loans. Banks, which had been earlier flushed with extra deposits from pandemic-era savings and stimuli bulked up on bonds and other fixed-rate investments like mortgage-backed securities. But as the Fed raised interest rates, those bonds became less valuable. [5] |

| 3 | Run on deposits | The collapse of SVB was triggered by a run on deposits. Customers began withdrawing their money from the bank in fear that it would fail considering that a high amount of the deposits were uninsured. This led to a liquidity crisis, which made it difficult for SVB to meet its financial obligations. |

| 4 | Investment decisions | SVB had designated 43% of its total assets as Held-to-maturity (HTM) securities. HTM securities are purchased to be owned until maturity and are shown at amortized cost or an adjusted version of the original price they paid and not at fair value. If banks designate bonds as held-to-maturity securities, the firms are allowed to exclude unrealized losses on them from equity as long as they don’t sell. On 31st December 2022, SVB reflected $91.3 billion of HTM financial instruments, 43.1% of its balance sheet, at amortized cost. Their fair value was only $76.2 billion, or $15.1 billion less than their carrying value. [7] [8] [9] |

| 5 | Poor risk management | SVB’s management team made several risky decisions that contributed to the bank’s failure. These included investing heavily in Chinese technology companies, which were vulnerable to the recent sell-off in Chinese stocks. |

| 6 | Regulatory capture | SVB was able to lobby for regulations that were favorable to its business model. This allowed the bank to take on more risk than it should have, and it also made it more difficult for regulators to intervene when the bank began to falter. The Economic Growth, Regulatory Relief, and Consumer Protection Act passed in 2018, eased the Dodd-Frank regulations for small and regional banks by increasing the asset threshold for applying prudential standards, stress test requirements, and mandatory risk committees. The law exempted lenders with assets of less than $10 billion from requirements of the Volcker Rule which prevented banks from investing in or sponsoring private equity or hedge funds and imposed less stringent reporting and capital norms on small lenders. [10] [11] |

| Bank | Proportion of uninsured deposits (%) | Loans + HTM securities / total deposits (%) |

| Bank of New York Mellon | 96.5 | 31.2 |

| Silicon Valley Bank | 93.9 | 94.4 |

| State Street Bank and Trust Co | 91.2 | 40.1 |

| Signature Bank | 89.7 | 93.3 |

| Northern Trust Co | 83.1 | 54.5 |

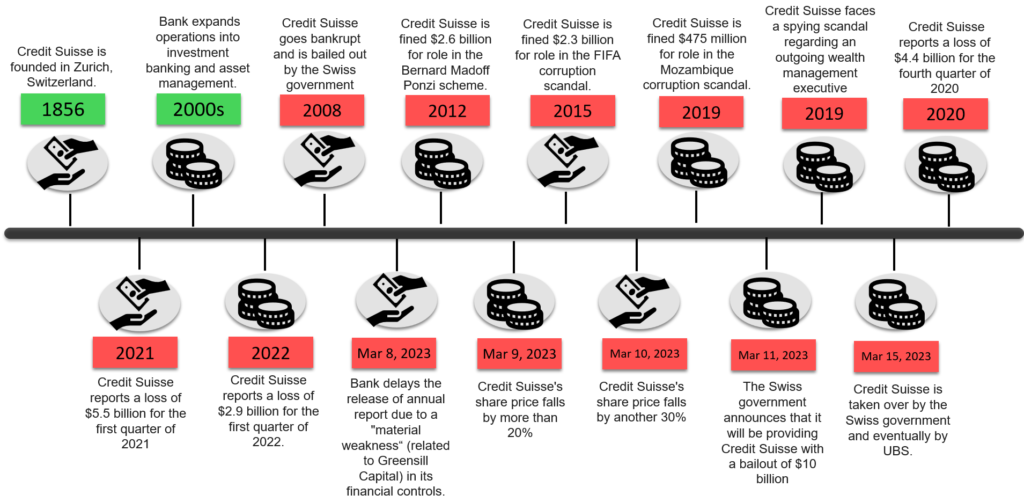

2. Credit Suisse

Timeline

Reasons for failure

| S.No | Heading | Description |

| 1 | The Greensill Capital and Archegos collapse | In 2021, amid the pandemic, the collapse of the U.S. family investment fund Archegos Capital and British finance firm Greensill Capital triggered a pretax loss of close to $1 billion for Credit Suisse. |

| 2 | A liquidity crisis | Credit Suisse faced a liquidity crisis in March 2023, which made it difficult for the bank to meet its financial obligations. This crisis was triggered by the bank’s declining share price and the withdrawal of customer deposits. |

| 3 | Series of high-profile scandals | Credit Suisse was involved in several high-profile scandals in the years leading up to its failure. These scandals damaged the bank’s reputation and made it more difficult to attract customers and investors. Credit Suisse reported an increase in litigation expenses by 600 million CHF. This negatively impacted their Q1 2022 revenue and they reported a loss. [12] |

| 4 | Poor risk management | Credit Suisse’s management team made several risky decisions that contributed to the bank’s failure. These included investing heavily in Greensill Capital and other risky assets. The team had several resignations, and changeovers affecting stability and highlighting internal crises. |

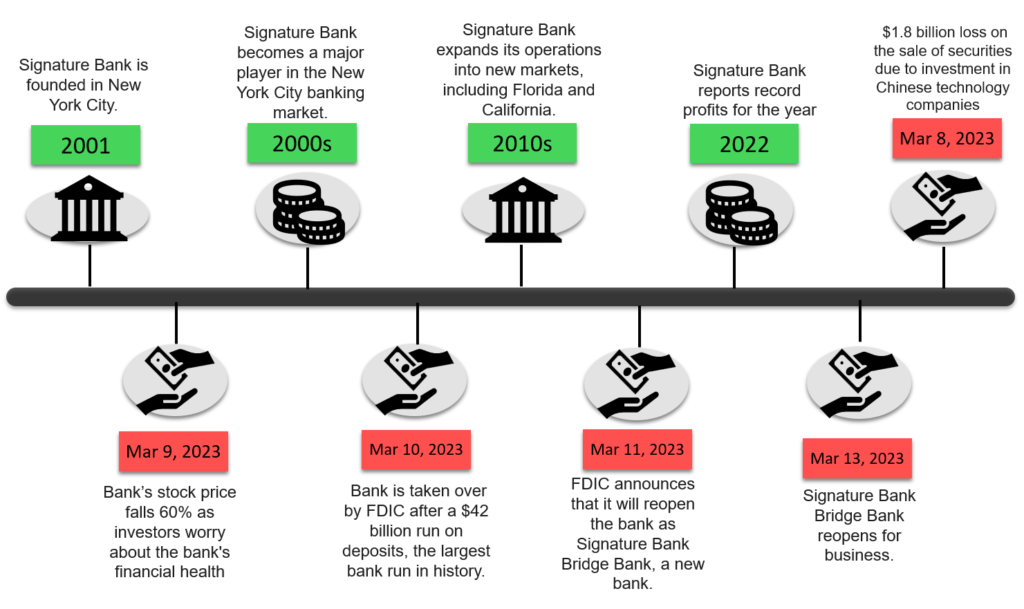

3. Signature Bank

Timeline

Reasons for failure

| S.No | Heading | Description |

| 1 | Heavy exposure to the technology & cryptocurrency industry | Signature Bank was heavily exposed to the technology industry, which was hit hard by the recent sell-off in tech stocks. The bank’s loan portfolio was concentrated in technology companies, and the loss of value in these assets contributed to the bank’s financial problems. By September 2022, nearly a quarter of its deposits were from crypto clients. Digital-related deposits reached $28.7 billion by the end of 2021—almost 30% of the bank’s deposit portfolio. [13] |

| 2 | Rising interest rates | The Federal Reserve began raising interest rates to combat inflation. This made it more expensive for Signature Bank to borrow money and reduced the demand for business loans. |

| 3 | Run on deposits | The collapse of Signature Bank was triggered by a run on deposits. Customers began withdrawing their money from the bank in fear that it would fail. This led to a liquidity crisis, which made it difficult for Signature Bank to meet its financial obligations. Only about 5% of its assets were in cash, compared to an industry average of 13% |

| 4 | Poor management | The root cause of failure cited by FDIC was poor management. The board of directors and management pursued rapid, unrestrained growth without developing and maintaining adequate risk management practices and controls appropriate for the size, complexity and risk profile of the institution. [14] |

| 5 | Regulatory oversight | Some experts have argued that regulatory oversight of Signature Bank was inadequate. This allowed the bank to take on too much risk and operate in a manner that was not in the best interests of its customers. |

II) Was it possible to predict the fire?

To analyze and understand the same, we use many widely used techniques that rely on the raw data sourced from a bank’s balance sheet, wondering if these could predict the failures of these banks. We then extend the usage of these techniques to a healthy bank (Bank of America) to check for uniformity and consistency.

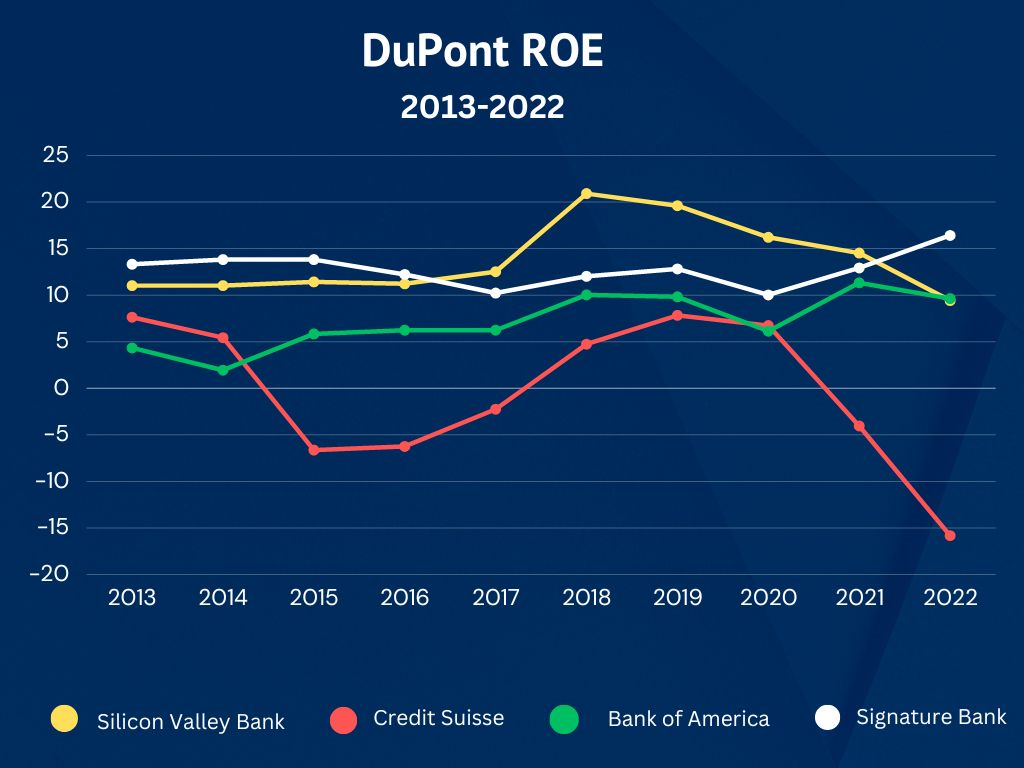

1) DuPont analysis

Definition: DuPont analysis is named after the DuPont Corporation, an American industrial company that popularized the framework in the 1920s.DuPont analysis is a financial performance measurement tool that provides a comprehensive analysis of a company’s return on equity (ROE). It breaks down the components of ROE into three key ratios: profitability, efficiency, and leverage, and the final ROE is obtained by multiplying these ratios.

Motivation behind selecting this approach:

i) Identifying Performance Drivers: DuPont analysis breaks down ROE into its constituent parts, such as profitability, efficiency, and leverage. This breakdown allows researchers to identify the specific areas where the companies may have faced challenges or exhibited strengths. By analyzing the trends and changes in these individual components over time, researchers can pinpoint the drivers behind the collapse and better understand the underlying causes.

ii) Comparative Analysis: DuPont analysis is particularly useful for comparative analysis between companies or across industries. By applying the same analytical framework to multiple banks, researchers can assess and compare the financial performance of the organizations. This enables a deeper understanding of the unique factors that contributed to the collapse of each company, as well as potential commonalities or differences in their financial strategies and risk management practices.

Explanation of employed terms:

- ROE:

Return on equity (ROE) = Net Income / Shareholders’ Equity

ROE is a gauge of a corporation’s profitability and how efficiently it generates those profits. The higher the ROE, the better a company is at converting its equity financing into profits.

The ROE using DuPont analysis for various banks:

Insights:

The ROE for Credit Suisse and Silicon Valley Bank declined in the recent years, indicative of the fact that their financial health may not be good. The ROE for the 3rd failed bank, Signature Bank, on the other hand had a strong value of 12.9%.

Limitations:

- Determining the values of a company’s accounting ratios as good or bad to compare them with the market value is difficult, as there are no uniform accounting methods.

- Seasonal factors, depending on the type of company, can severely affect the accounting ratios and cannot be easily overcome.

- Different accounting practices and methods between companies can also make accurate comparisons difficult. [15]

2) Altman Z score analysis:

Definition: The Altman Z-Score for banks is a quantitative model developed by Edward I. Altman in 1968 to assess the financial health and risk of bankruptcy of banking institutions. It utilizes a combination of financial ratios to calculate a single numerical score that indicates the likelihood of a bank experiencing financial distress or failure within a specified time frame, typically one year.

Motivation behind selecting this approach:

i) Bankruptcy Prediction: The Altman Z-score analysis is a widely recognized and established model for predicting the likelihood of bankruptcy or financial distress for a company. By using the Altman Z-score analysis, we aim to determine whether these banks exhibited signs of financial distress or were at risk of collapse based on their financial indicators.

ii) Early Warning System: The Altman Z-score analysis serves as an early warning system for identifying potential financial distress well in advance. By examining a set of financial ratios related to liquidity, profitability, leverage, solvency, and other key indicators. The model provides a quantitative assessment of a company’s financial condition. In the case of banks, using the Altman Z-score analysis can help identify warning signs and triggers that may indicate impending trouble, allowing stakeholders to take preventive measures.

Altman Z score = (6.56*A+3.26*B+6.72*C+1.05*D)

Criteria:

- Safe Zone: (Z -Score)>2.99

- Grey Zone: 1.8<(Z -Score)<2.99

- Distressed Zone: (Z -Score)<1.10

Explanation of employed terms:

- Working Capital = Current assets – Current liabilities. It indictes the liquidity levels of businesses for managing day-to-day expenses.

- EBIT: Earnings before interest and taxes (EBIT) indicate a company’s profitability.

EBIT = Revenue – expenses (excluding tax and interest)

Calculation of Altman Z score:

| Bank’s Z Score Interpretation | ||||

| Years | Credit Suisse | Silicon Valley Bank | Signature Bank | Bank of America |

| 2013 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2014 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2015 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2016 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2017 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2018 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2020 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2021 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

| 2022 | Grey Zone | Distressed Zone | Distressed Zone | Distressed Zone |

Insights:

From 2013 to 2022, the Altman score of Credit Suisse consistently placed it in the “Grey” category, indicating that the bank’s failure could not be accurately predicted or justified solely based on Altman’s analysis. The Altman score of Silicon Valley Bank and Signature Bank consistently placed it in the “Distressed” category, indicating that the bank’s failure could be accurately predicted or justified solely based on Altman analysis. Bank of America’s Altman score categorizes it as being in the “distressed” category from 2013 to 2022, it is important to note that the bank has maintained its stability and survived.

Limitations:

- The Altman Z score model provides accurate data only if the data input is reliable. Any prior manipulation of input data is not accounted for under this analysis.

- A company in distress doesn’t mean it is going to be bankrupt in the near future, it only says that the company’s current financial health is not good, so they may have chances of bankruptcy in the near future. [16]

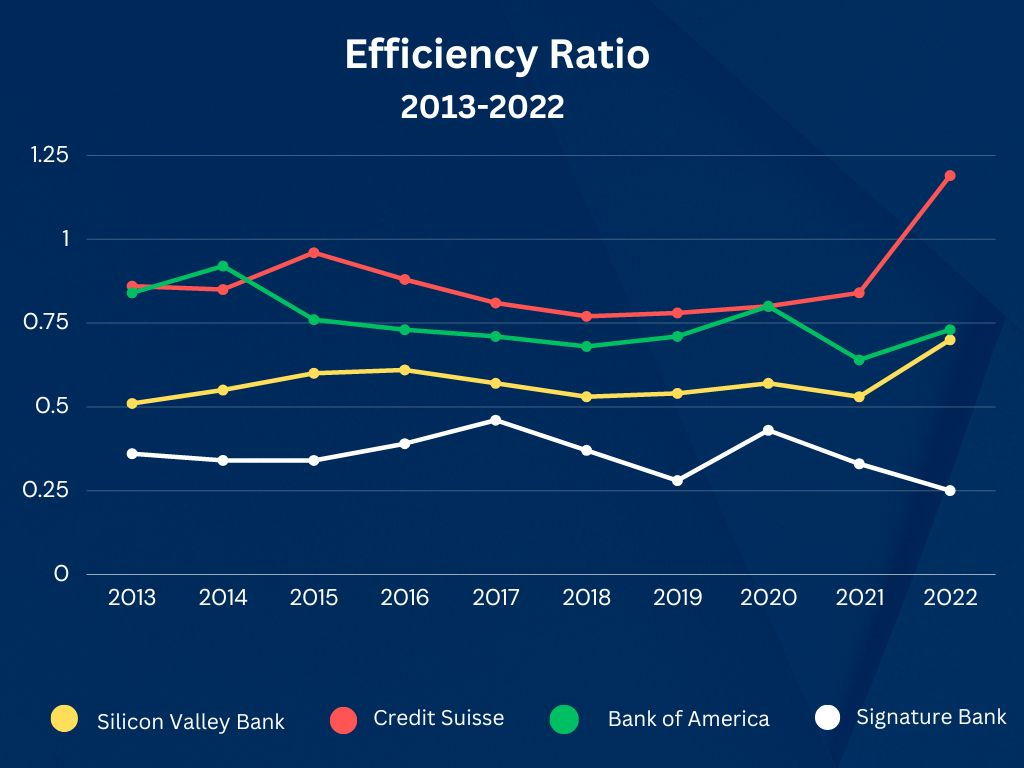

3) Efficiency ratio:

Definition: The efficiency ratio is a calculation that compares a company’s expenses or costs to its revenue or income. It is typically expressed as a percentage or a decimal. lower efficiency ratio indicates better efficiency, as it implies that a company is able to generate more revenue with fewer expenses. Conversely, a higher efficiency ratio suggests that a company is less efficient in converting its resources into revenue.

Motivation behind selecting this approach:

i) Cost Management: The efficiency ratio evaluates the relationship between a bank’s expenses and its revenue. In the banking industry, where operational costs can significantly impact profitability, monitoring and managing expenses is crucial. A high efficiency ratio may indicate inefficiencies, such as excessive operating expenses or low revenue generation relative to costs. These inefficiencies can strain a bank’s financial health and increase the risk of failure.

ii) Comparative Analysis: The efficiency ratio allows for comparisons between different banks or within the banking industry. By benchmarking a bank’s efficiency ratio against peers, industry averages, or historical trends, analysts can identify outliers or banks with suboptimal efficiency. Banks with consistently higher efficiency ratios relative to their peers may face a higher risk of failure due to their lower ability to generate revenue or manage costs effectively.

Formula:

Efficiency ratio = Operating expenses/Net revenue

Insights:

The 2022 Credit Suisse efficiency ratio was 1.190, a cause for concern that exceeded industry standards and was more than double the generally accepted threshold. A notable increase in the efficiency ratio indicates higher operating expenses relative to net interest income.

Efficiency ratio of Silicon Valley Bank in 2022 spiked to 0.70.

Signature Bank consistently maintained efficiency ratios below the industry threshold throughout the analyzed period. Despite being a failed bank, Signature Bank’s efficiency ratios were relatively good.

Efficiency ratio values of Bank of America from 2013 to 2022: consistently high (0.64 to 0.92). Bank of America’s efficiency ratios indicate higher operating expenses compared to net interest income. Despite higher efficiency ratios, Bank of America has maintained its position as a healthy bank

Limitations:

- Seasonal Influences- Sometimes, a company may accumulate stocks and buy equipment in preparation for a “high-season” when sales are higher. As such, the efficiency ratios may be lower, though this is not the case.

- Different Accounting Practices- Different firms use varying accounting practices, meaning one should exercise discretion when using the efficiency ratios.

- Most giant companies, or conglomerates, operate in different business sectors. This means it is hard to obtain solid data for cross-comparison. [17]

4) Piotroski F-Score

Definition: The Piotroski F-Score, named after its creator Joseph Piotroski, is a financial scoring system that evaluates the fundamental strength and financial health of a company. It uses a set of nine criteria to analyze various financial metrics and assigns a score ranging from 0 to 9. The higher the score, the stronger the company’s financial position.

Motivation behind selecting this approach:

i) Identifying financially distressed companies: It was developed with the motivation of identifying financially distressed companies that have the potential to recover and perform well in the future. The creator of the F-Score observed that many value investing strategies focused on buying stocks with low price-to-book ratios. However, he wanted to go beyond just the valuation metric and identify companies with solid financials and positive prospects for improvement.

ii) Systematic and objective approach: The F-Score incorporates a set of financial ratios and metrics that capture different aspects of a company’s financial performance. By evaluating profitability, leverage, liquidity, and operating efficiency, the F-Score provides a comprehensive assessment of a company’s financial condition. It is used as a tool to aid investment decision-making, particularly in value investing strategies, where investors seek to identify bargains in the market.

Method:

The nine criteria used to calculate the Piotroski F-Score are:

Profitability Criteria Include:

- Positive net income (1 point)

- Positive return on assets (ROA) in the current year (1 point)

- Positive operating cash flow in the current year (1 point)

- Cash flow from operations being greater than net Income (quality of earnings) (1 point)

Leverage, Liquidity, and Source of Funds Criteria Include:

- Lower amount of long term debt in the current period, compared to the previous year (decreased leverage) (1 point)

- Higher current ratio this year compared to the previous year (more liquidity) (1 point)

- No new shares were issued in the last year (lack of dilution) (1 point).

Operating Efficiency Criteria Include:

- A higher gross margin compared to the previous year (1 point)

- A higher asset turnover ratio compared to the previous year (1 point)

For each of these criteria that a company meets, it receives one point. The total score is the sum of the points earned across all nine criteria. A higher score indicates stronger financial performance and can be used by investors and analysts as a tool to identify companies with potential improvement in their financial situation.

Calculation of Piotroski F-Score for various banks:

| Piotroski F-Score of banks | ||||

| Years | Silicon Valley Bank | Credit Suisse | Signature Bank | Bank of America |

| 2013 | 7 | 5 | 8 | |

| 2014 | 4 | 3 | 7 | 7 |

| 2015 | 3 | 4 | 6 | 5 |

| 2016 | 6 | 5 | 6 | 6 |

| 2017 | 8 | 3 | 6 | 6 |

| 2018 | 6 | 6 | 6 | 7 |

| 2019 | 9 | 5 | 6 | 5 |

| 2020 | 6 | 4 | 7 | 6 |

| 2021 | 5 | 4 | 6 | 4 |

| 2022 | 5 | 4 | 4 | 6 |

Insights:

SVB had a perfect Piotroski score of 9 in 2019, followed by a depletion of the score in the following years. It had a Piotroski score of 5 in 2022 indicating that the financial strength of the bank was decent if not strong. Credit Suisse had a stable Piotroski score of 4 for 2020, 2021, and 2022 indicating that the financial strength of the bank hadn’t improved over the years. Signature Bank maintained a consistent Piotroski score of 6 from 2015-2019. The score went up in 2020 and declined in 2021 and 2022. Bank of America had a Piotroski score of 6 in 2022 indicating that the bank’s financial health was decent. The Piotroski F score couldn’t predict the failure of any of the 3 failed banks.

Limitations

- It compares the performance of companies based on the previous year’s data. Therefore, there is a chance that it might show that high-quality stocks are not that great. This is especially true in the case of cyclical stocks and when unusual events like the pandemic affect the markets.

- This ratio majorly focuses on trends and not on the absolute changes within a criteria. [18]

Conclusion

The techniques used above are some of the most common when predicting the health of various stocks and can be found on all trading platforms. However, they all end up giving us contradictory results leading us to wonder if there’s something at all that can correctly predict the failure for all of the banks. Another major disadvantage is that they rely heavily on the data from a company’s financial statements, some of which can be easily manipulated by companies, so they may not be accurate. This calls for new techniques to be developed keeping in mind the dynamism of the economy and the rapid pace of technological development. Probably a mix of both quantitative and qualitative techniques can answer our question of predicting the fire and preventing banking failures.

One of the possible solutions that could have avoided the crisis is if the Dodd-Frank regulations had been implemented strictly. Another possible solution is considering the metric of uninsured leverage. Uninsured leverage is the ratio of a bank’s uninsured debt to its assets. Uninsured debt is debt that is not insured by the Federal Deposit Insurance Corporation (FDIC). This means that if a bank with uninsured debt fails, its creditors will not be able to recover their money.

High uninsured leverage played a critical role in the failure of SVB. 10 percent of banks had larger unrecognized losses than those at SVB. SVB wasn’t even the worst capitalized bank. There were 10 percent of banks having lower capitalization than SVB, so why did SVB fail and not any other bank? That’s because SVB had a disproportionate share of uninsured funding: only 1 percent of banks had higher uninsured leverage. Combined, losses and uninsured leverage provided incentives for an SVB uninsured depositor run.

Unlike insured depositors, uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run. Consequently, a bank’s survival depends on the market beliefs about the share of uninsured depositors who will withdraw (or equivalently ask for a higher deposit rate), following a decline in the market value of the bank’s assets. If interest rate increases are small such that the decline in the bank’s asset values is relatively small, we are in a “good” equilibrium with no possibility of a run. However, for sufficiently high increases in interest rates, a “bad” equilibrium with uninsured depositors runs making banks insolvent becomes a possibility. For banks with smaller initial capitalization and higher uninsured leverage, the range of sustainable beliefs supporting a “good” equilibrium without an uninsured depositor run is smaller, increasing the bank’s fragility. In other words, in such situations a bank remains solvent only if a relatively small share of the uninsured depositors is expected to withdraw, otherwise, there will be a run on the bank.

The Federal Reserve should take steps to reduce the level of uninsured leverage in the banking system. This could be done by raising capital requirements for banks to ensure their likeability to survive a financial downturn/losses or by providing liquidity support to banks that experience mark-to-market losses so the hit faced by the banks due to the stocks being shown at their amortized cost rather than the market value can be minimized.[19]

References

1. BU Economists Weigh in on Banking Crisis | Center for Innovation in Social Science

2. Why did Silicon Valley Bank fail? – Economics Observatory

3. KPMG gave SVB, Signature Bank clean bill of health weeks before collapse | Mint (livemint.com)

4. Venture-Funded | Silicon Valley Bank (svb.com)

6. Why did Silicon Valley Bank fail? – Economics Observatory

8. Held-to-Maturity (HTM) Securities: How They Work and Examples (investopedia.com)

9. Banks, Investors Revive Push for Changes to Securities Accounting After SVB Collapse – WSJ

11. Dodd-Frank Act: What It Does, Major Components, and Criticisms (investopedia.com)

12. Credit Suisse Expects First Quarter 2022 Loss – Markets Media

13. Wayback Machine (archive.org)

14. FDIC Releases Report Detailing Supervision of the Former Signature Bank, New York, New York | FDIC

15. DuPont Analysis and its importance in ROA & ROE (finology.in)

16. ijcrt.org/papers/IJCRT2012246.pdf

17. Types of Efficiency Ratios Used in Measuring Business Performance – Udemy Blog

18. What is Piotroski Score? Parameters, Limitations & Much More (tradebrains.in)

19. Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs? by Erica Xuewei Jiang, Gregor Matvos, Tomasz Piskorski, Amit Seru :: SSRN